Dealing with HMRC can be a time suck for business owners. Luckily, we can help! Adding Fearless Financials as your agent means we can submit your returns directly to HMRC, check the information they hold to make sure there aren’t any issues, and talk to HMRC on your behalf.

The quickest way to add Fearless Financials is through your Government Gateway account, using our agent code (as long as the relevant tax is set up on it). Alternatively, we can request a one-off code from HMRC through the post which you then pass on to us. Or, as a final resort, there is the old-school paper form that can be sent to HMRC.

It’s quick and easy to set up. Note that these steps use Self Assessment tax for the example, but similar processes can be used for Corporation Tax and PAYE (limited access). VAT now requires a slightly different process.

Let’s take you through the steps on how to grant us access:

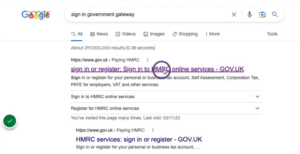

1.Find the sign-in site for HMRC Online Services.

Either use a saved URL or search for it as below.

2. Click on the “Sign in” button

3. Enter your Government Gateway user ID and your password

Top Tip: Save these to a password manager (we are big fans of LastPass here at Fearless Financials!)

4. Complete the two-factor authentication check.

Input the access code sent to your phone and follow the instructions. Ticking the “Remember me for 7 days” box means you’ll be able to sign in for a week without receiving a code via text.

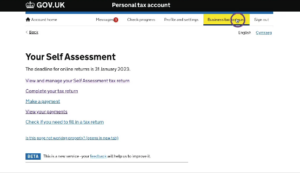

5. Make sure you’re in the area labelled “Business tax account” (it often defaults to your personal tax account when you sign in if you are a sole trader).

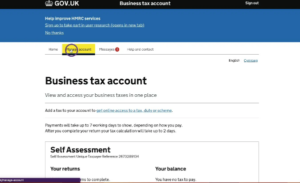

6. Find “Manage account” in your business tax account

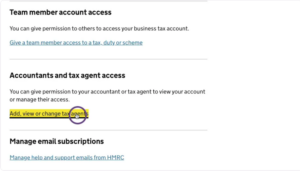

7. Scroll down to find the section titled “Accountants and tax agent access”, and click on “Add, view or change tax agents”.

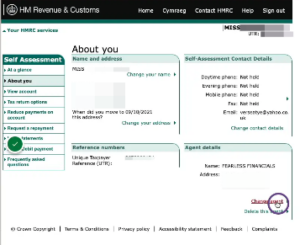

8. You’ll be brought to the page shown below, where you need to click on “Change agent” (circled in the bottom right-hand corner).

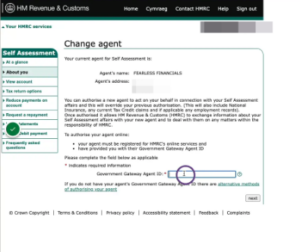

9. Copy and paste the Fearless Financials Agent ID into the box shown below.

Our code is FEARLESSFINA-Q1CEGWWTAPK5. Click “next” and follow the instructions to complete.

10. You’ve done it! Sit back, relax, and look forward to fewer HMRC headaches.

If you have further queries or questions get in touch with our team!